Points: How Reputation & Tokens Collide

Points are here and they signal how networks and apps will evolve next with verifiable data.

Points have taken Web3 by storm in the last six months, catalyzed by projects like Blur and EigenLayer rewarding users with points on the way to seizing the NFT market and amassing $7 Billion TVL respectively. More than 115 Billion points have been given out by Web3 projects so far, according to Tim Copeland at The Block.

There are two ways to look at points:

- As a precursor to an airdrop. Projects use points ahead of a token to generate interest, signal what they care about and will reward, more effectively target engagement, and navigate legal risks associated with tokens.

- As a measure of quantifiable reputation. Points ascribe a value to user activity, just like many reputation systems have before: traditional loyalty programs, Reddit karma, check-ins, credentials. They can signal legitimacy in pseudo-anonymous systems and — because they’re more quantitative than, for example, verifiable credentials — standing within the community.

Both of these are right. Points align the incentives of the platform and the user base, like all reputation systems. And they forecast who is creating value and is likely to be rewarded. By understanding how these two intersect, we can forecast where Web3 will go far beyond today’s points craze.

Points are quantifiable like money, enduring like reputation

Tokens were the first major innovation of Web3 and the primary incentive. They offer fully quantifiable value, are transactional, and require no additional context. They work as “one time games.” Reputation is how social systems achieve repeat game use cases, rewarding ‘good behavior’ of an actor (e.g. following contracts and policies, not cheating counterparties) with access and benefits over the long term. Reputations are non-fungible — for them to establish trust, it has to be hard to buy reputation.

Points are proof of activity that act as a building block for reputation (and in Web3, often carry the suggestion of future value). **All reputations come with some benefit. Usually, they’re more subtle than financial rewards. Reputations might gain access to a service (credit score) or club (referral), earn discounts (loyalty programs) or introductions (dating), convince counterparties to transact (Uber rating, credit lending), and build trust with customers (influencers, corporate brands). Reputations are less measurable than financial assets, but often more valuable.

For Web3 to grow into social and other non-financial use cases, more robust reputations are needed. Points are not an isolated mechanism to forecast token earnings — they are one point on a broad spectrum of token (financial) and reputational rewards that Web3 will keep innovating on.

Points as part of the evolution of Web3 reputation

Reputation naturally starts in the most discrete, high-value places and evolves to more broad ones.

1. B2C “Badges”

The earliest forms of reputation helped networks solve discrete pressing problems: anti-sybil and KYC. This involved a business or service issuing badges to users for achieving important milestones. For example, Gitcoin Passport stamps prevent sybil attacks in Grants rounds for Ethereum and other ecosystems. The meaning of the badge is objective and clearly denominated.

2. Attestations

After discrete badges, platforms needed reputation for a wider variety of activities and credentials: history of contribution, trust as a delegate, skills in a DAO, proof of activity. Attestations are still clearly denominated, but rather than signifying a clear milestone like badges they’re more continuous.

This also started B2C (for example, participating in an event, completing a certain step in a user flow, etc.) EAS has emerged as a standard for issuing these, used natively in the Optimism stack and widely in Ethereum. Increasingly, attestations are community-driven as well. Open platforms let users create and verify claims. For example, Metamask is working on a review and reputation system for Snaps.

3. Points: scored activity

On-chain transactions, B2C badges, and attestations are all cryptographically verifiable actions. Users do something that has provable provenance and time, whether that’s on-chain or off-chain signed data.

Point systems specify which of these activities have value in their system (and how much), tabulate them over time for each identity, and ascribe a numeric ‘point’ value to them. Points create a quantifiable reputation that continuously aggregates the previous forms.

4. Events: all activity

There’s no reason to believe the evolution will stop with points. At scale, all of a user’s activities in Web3 apps and platforms will be recorded as cryptographically verifiable events. This might be likes on a cast, messages on a forum, contributions to a codebase, visits to a blackbird restaurant, etc.

These are all events, and they all have value — but it’s not always known up-front what that value is. Some might have value in driving community engagement, others in improved analytics for products or targeting for ads, some as inputs into reputation systems. Because all will be cryptographically recorded, they can be referenced any time in the future.

Points will dominate for now, but before long we’ll see a huge increase in retroactive airdrops, activations, rewards, access, and other forms of value awarded to users based on a much broader history of their events — not just those that are made explicit up-front via point systems.

Infrastructure for points, events, and trust

All of these forms of reputation serve to reward users. Web2 used points exhaustively, but Web3 can uniquely do it openly and with composability. By making every event driving points both transparent and verifiable, events and points can be leveraged across platforms and have trust built in. This trust can reinforce future rewards, encourage more activity, and enable cross-platform point innovation.

Unfortunately, while points are proliferating, to date most haven’t tapped into this unique Web3 possibility — most have been tabulated on centralized databases, putting rewards at risk.

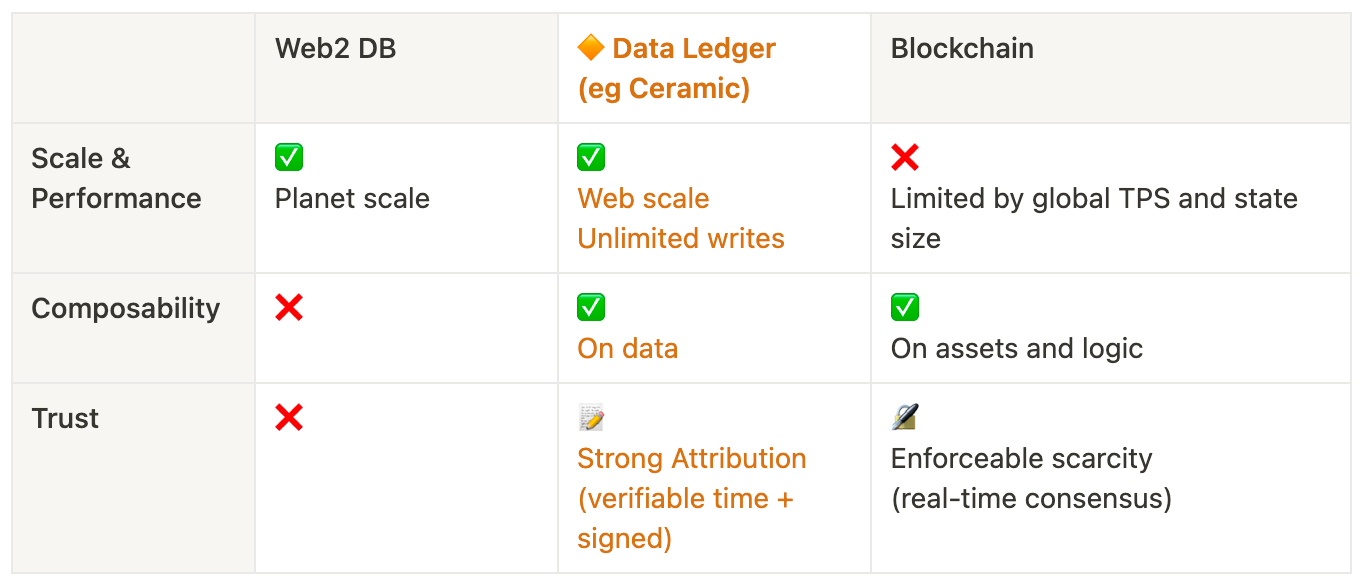

Data ledgers vs. asset ledgers

Financial blockchains were built to be asset ledgers, not point or event ledgers. They’re designed for scarcity; e.g., they must protect against double-spend as a core principle. Points are not bought, sold or traded like assets — they’re earned. They’re best served — fast, cheaply, scalably — on a data ledger.

Data ledgers, for data that is not scarce, operate with different principles. They must still offer strong verifiability and composability; but they don’t have to protect against double spend, and they must scale many orders of magnitude beyond asset ledgers. There are exponentially more data transactions than asset transactions in any web service.

Ceramic is the first decentralized data ledger with the scale, composability, and trust guarantees required to be a system of record for points and events. It’s built to enable the scaling of Web3 beyond financial transactions to richer experiences, including those powered by attestations, points, and the billions of events that are coming to enable a data-rich Web3.

Building with Points

If you’re thinking about a point system for your product, or how to advance point-enabled experiences, please reach out to partners@3box.io.

If you are interested in emerging standards for points, reach out to us on the Ceramic discord to learn more about our working group.

If you’ll be at EthDenver next week, come talk points, reputation and verifiable data with us at Proof of Data.